Download the PDF version of the Working Paper Here.

Overview

This paper considers the changes in the business environment due to the coronavirus and the new challenges and opportunities that it brings to businesses. The paper will focus on discussing potential methods which can be adopted by businesses to advance and overcome the challenges faced in order for them to thrive in the post circuit breaker period.

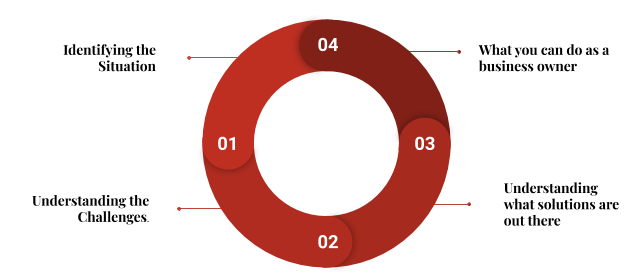

We will focus on 4 Areas – which helps to bring a greater understanding to business owners of what they can do during this period.

Business Environment Changes

COVID-19 has significantly altered the business environment for various industries and businesses have to keep up with the changing business landscape in order to stay relevant.

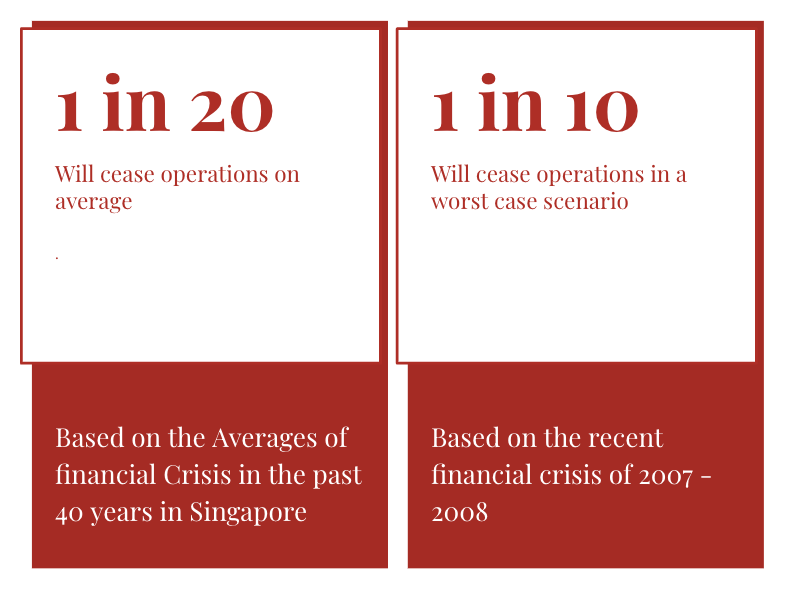

From the estimates of Forbis Data Analysis based on data from Singstats- we can expect that on average between 1 in 10 to 1 in 20 companies will cease operations due to not being able to cope with the current crisis.

The pandemic has caused dramatic shifts in online purchases, and online fulfilment of consumer and business services and goods. As consumers now more than ever turn to digital stores and digital vendors instead of brick-and-mortar outlets; it has become an accelerant in the digitalisation of industry

This new business paradigm shift has yielded significant results for businesses who digitised their operations beforehand. That being said, it is not easy for a business to carry out digital integration due to the high costs which are required and particularly more significant for SMEs.

Such impacts are most easily observed in the dramatic rise of Amazon and the recent fall of major retailer J.C. Penney Co.. Companies who have yet to digitise their operations are now forced to consider implementation of technology as a core key strategy to their business operations in order to keep up with consumer demand and stay relevant.

One of the most prevalent examples is the food and beverage (F&B) industry, where many traditional F&B outlets are flocking to online food applications to reach out to a wider audience. In fact, even at the height of the pandemic, high-ticket price discretionary goods such as automotives have been sold in a digital fashion showing that various industries and goods all face a similar change in their business environment.

A good example of a company who has successfully adapted to the change in the business environment would be Volkswagen. As explained by Michael Mayer, head of sales and marketing for Volkswagen in China, he stated that cars were sold in the month of March through the use of virtual showrooms. He also acknowledges the importance of digital commerce where more than 2,000 Volkswagen dealerships are presenting the current line-ups via live streams. Furthermore, Volkswagen has implemented and is able to process online purchase credit agreements. These highlights how rapid changes in the business environment can be overcome as long as businesses realise the necessary and critical need for technological implementation across firmwide operations.

As we now know, COVID-19 has caused major disruptions in commerce and made apparent the fragments within the global supply chain. This global shift in supply chain is particularly important to Singapore as about 17 percent of Singapore’s exports is to China. A diversification in Singapore’s trading partners also provides flexibility in its management of trading ties with China.

Companies which heavily relied on China’s labour force for production are now looking to diversify their production instead of solely depending on a specific geographical location due to overconcentration risk. Eventually, when the dust of COVID-19 settles, companies will likely begin to move production out of China to alleviate geopolitical tensions as well as reap potential tax incentives. In addition, with labour costs in China rising, the relatively low labour costs of Southeast Asia makes it an attractive destination. This presents an opportunity for Singapore, which as a stable regional hub, can provide professional advisory services for global companies shifting capital into the region. The question remains whether businesses in Singapore are well equipped to support this paradigm shift.

Businesses Challenges

Trade

Singapore is highly reliant on global trade and in particular China, a major disruption such as COVID-19 highlights the over-exposure of materials supply from certain regions around the world. Even as countries start to reopen, albeit in an uncoordinated manner, the sourcing of materials from a myriad of locations means that the procurement of raw materials and delivery of final products may be delayed. This poses a significant challenge as Singapore’s economy is dependent not only on its internal policy but also that of its trading partners.

While the circuit breaker measures has somewhat limited the local transmission, it has also hit many business sectors in Singapore. Ultimately, it is a trade-off. The disruption in economic activity has resulted in unstable cash flow of many firms.

Some sectors are battered particularly hard. According to a survey done by Chope, a restaurant reservations platform, 78 percent of restaurants in Singapore are unprepared to last longer than six months if the situation does not improve. Furthermore, a third have asked full-time employees to take compulsory leave. However, it must be noted that the food & beverage industry only contributes about 1 percent towards Singapore’s GDP. Nonetheless, it underscores the importance of cash flow management, especially for businesses with cyclical cycles.

Productivity

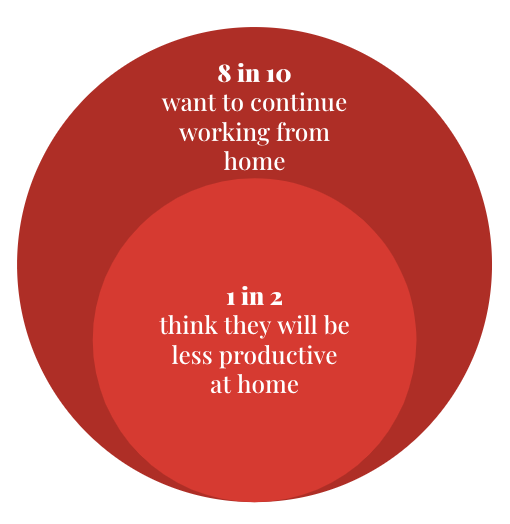

The circuit breaker has also brought about the closure of workplace premises, forcing most non-essential employees to work-from-home (WFH). This by itself is a broad problem for employers in terms of productivity and efficiency. The nature of certain sectors and company specific operations may result in an inadequacy in shifting work home. According to a survey by EngageRocket, the Institute for Human Resources Professionals and the Singapore Human Resources Institute 8 in 10 employees want to continue working from home, which shows that WFH schemes are a very attractive talent proposition. However, at the same time 1 in 2 think they will be less productive at home.

This may seem contradictory at first. Our analysis of the situation, in combination with our own data from our Clients is that employees want a better work life balance with WFH schemes, but at the same time, both employers and employees do not know how to make it work, causing reservations about their productivity when doing WFH.

Furthermore, there is evidence of generational differences in productivity. Further elaborating on the survey, employees below 30 years old were less likely to report lower productivity due to WFH arrangements as compared to those above 40 years old. In general, this is in part due to distractions and resource inaccessibility. This poses an enormous challenge for businesses which forces them to consider more telecommuting options going forward.

These factors add to the uncertainty of business operations which make it challenging for businesses to cope with their productivity during these times.

Advancing and Overcoming the Challenges

The Public & Private Partnership (PPP) Model

Since two thirds of Singapore’s workforce are employed by SMEs, it is critical for both the government and private sector to work in-tandem during this period. The government is putting out strong measures to support SMEs during this pandemic. Concurrently, businesses will also have to re-evaluate their business model in order to adapt to the current situation.

The Government – Fiscal Stimulus & Other Support

A key challenge brought about by the circuit breaker is the major disruptions in businesses which have caused unstable cash flows. In order to help businesses who are struggling financially, the Singapore government has made efforts to ensure liquidity in financial markets. This can be seen in April, where MAS and ESG launched a new lending facility to loan Singapore dollars to eligible financial institutions at 0.1 per cent. This comes as a complement to the government’s increase in risk-share of loans of 90 per cent. By providing financial institutions cheaper funds and cushioning the credit exposure, the government hopes to lower the borrowing costs of small and medium enterprises (SMEs) in Singapore. This has translated to realised benefits; DBS alone has approved S$ 1.1Bn in loans to micro and small enterprises with lower interest rates.

The government has also put out multiple schemes for various sectors ranging from Transportation to Finance, to assist companies in various operational areas – chiefly, digital transformation and business remodelling to give companies the tools they need to get ahead of the curve.

Private Sector – Transformation & Remodelling

In addition, the nature of this pandemic has caused businesses to operate from home and provide services and products online. Hence, more businesses are contemplating integrating their operations digitally even as the economy starts opening up because of the changing consumer behaviour pattern so as to obtain a competitive edge over their competitors. Businesses which undergo this transformation and remodelling process will be able to reap the benefits during the recovery.

To assist businesses make the shift to a more seamless and technologically driven operation, financial aid from the Infocomm Media Development Authority (IMDA) and ESG will be given in the form of grants which subsidise up to 80 percent under the SMEs Go Digital Programme. This is to aid SMEs who wish to adopt technology which will boost productivity and growth but face financial difficulties.

Businesses also have to act fast to mitigate risks rather than take a wait and see approach. According to Bain & Company, as a starting point, businesses should highlight alternatives in the different tiers of suppliers and the likely scenarios with adequate contingency plans. Thus far, improvements in technology has allowed businesses globally to model supply disruptions in real time. This enhances businesses’ ability to operationally tread through an increasingly uncertain world. Correspondingly, subsidies like the Go Digital Programme also allows SMEs in Singapore to adopt technology and transform their business.

In conclusion, COVID-19 may have brought about unfamiliar changes to the business environment which can create challenges for many businesses across various industries alike but in the end with proper planning and implementation of solutions, such challenges can be overcome to bring about a stronger economy that is better prepared for unforeseeable business shocks.

What can you do as a business owner?

As a business owner, how does all this help you? You can depend on this as a summary in a nutshell. By observing the trends in the challenges and solutions – we believe that focusing on a few key areas will serve business owners well. At Forbis, we are constantly assisting our Clients to achieve business success and to manage their businesses effectively.

We have developed our own simple process model based on assessing and solving business needs for SMEs to incorporate into their business strategy to weather out the storm by leveraging on organisational knowledge from various sectors.

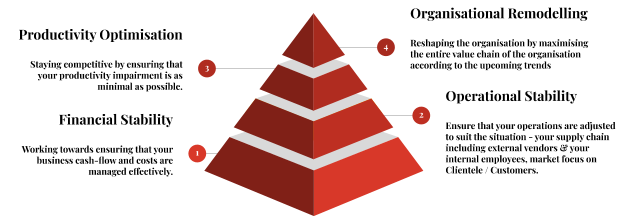

It consists of 4 Key focus areas in ascending order of importance, from levels 1 to 4. The diagram below provides a key overview of the process.

We will delve deeper into each area in the following pages and highlight the thought processes and the actions necessary to solve each issue.

Financial Stability

Look into your businesses finances, costs and revenue keeping in mind the following questions:

- How long can you continue to manage with the current numbers? By when do you think you will run out of cash-flow? Consider the best and worst case scenarios.

- How long do you think the situation will last for your particular business?

- What actions can you take to reduce costs and increase revenue?

Once you have those questions in mind. It is time to look at the solutions. If you have insufficient cash-flow to make it through the period, you will need an external capital injection either in the form of Debt (Loans and Bonds) or Equity (Shares). You can ask yourself the following questions:

- How much money do I need?

- How soon do I need the money? (Debt is faster than equity in general for fundraising)

- What are my businesses’ assets? These can be tangible and intangible – for example, a business that has a strong revenue pipeline in terms of contracts, but does not have current operational cash-flow may use those contracts as a tool for requesting capital

In general, these are the characteristics of equity versus debt. There are of course, instruments to raise capital that are in between the two that has characteristics that are blended.

Operational Stability

Understand your business operations and compare them against the current trends. Assessing your current value chain is extremely important as it allows you to figure out the relevant adjustments that need to be made to your business in order to protect your business interests during turbulent times.

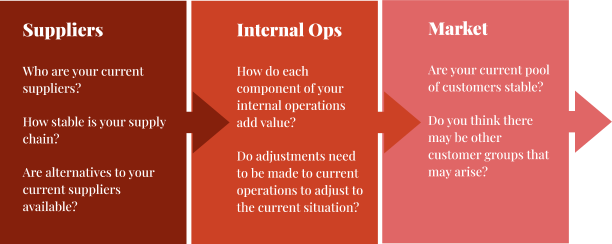

Looking into the entire value chain can be simplified into 3 parts – your suppliers, your operations which value add and your market (clients / customers). Some key questions you should ask yourself are:

- What are your businesses current operations? How are they impacted in the current situation?

- Does a particular part of your businesses’ operation need to change in order to stay relevant?

- Do you require alternative suppliers?

- Is your manpower optimal? Do you need to reallocate your manpower?

Productivity Optimisation

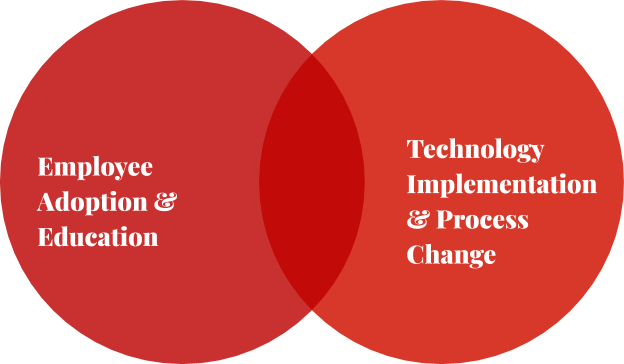

Productivity impairment is unavoidable during this period. However, there are many ways to get around to ensuring that organisation stays productive. The main two key areas to look into are employee adoption and education and technology implementation and process change.

Some questions you should consider asking yourself and brainstorming with your employees:

- What is currently lacking in terms of productivity? Is it teamwork, collaboration, coordination, administrative or shortfalls in other areas?

- What technology implementation or process change do you think is necessary to cover this? For example, there are many open source and free online collaboration tools that allow staff to work together in a digital environment (sharing of documents, ideas, communicating via chat, video conferencing, managing tasks)

- How do you think your employees can adopt these new processes and technology the best??

Organisational Remodelling

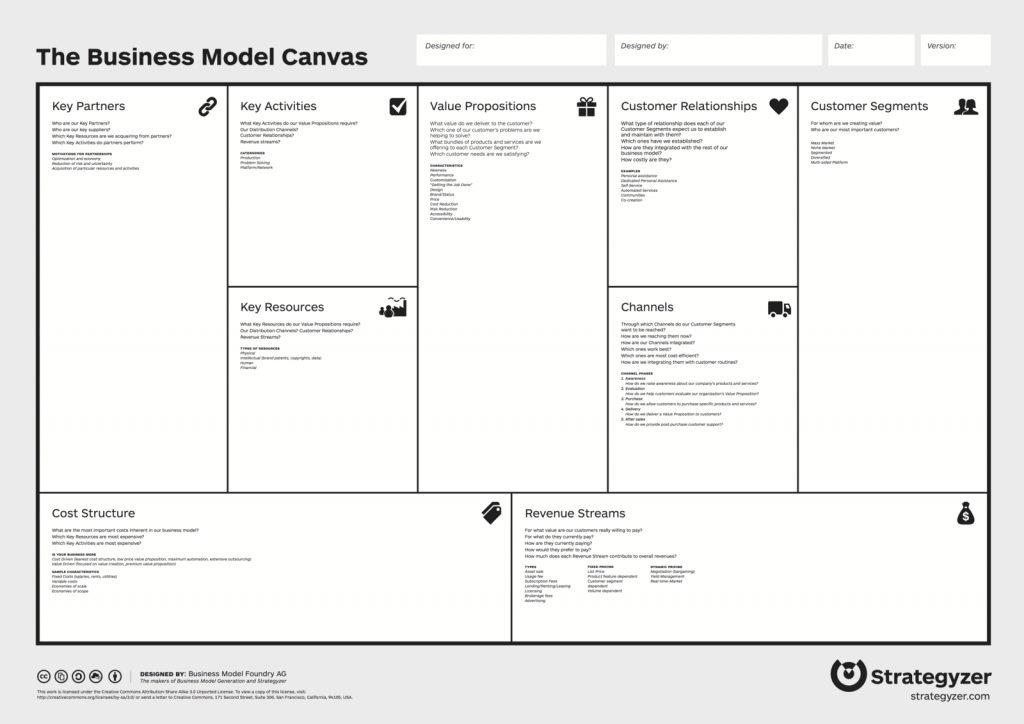

Once you have sorted out the major issues that are impeding your organisation’s stability and growth. The last item you will need to take care of would be organisational remodelling. This takes into consideration what you need to do, to future-proof your business and leverage on the changes that will come.

This part taps on your learning experiences from part 2 and 3.

For this, you will need to ask yourself a few questions:

- Are there any new markets (either geographic or demographic) that your business can tap on?

- Can your product / service be modified and altered to fit the upcoming trends better? Or can it be altered to serve a completely new market?

- Are there parts of your business (business units) that you can convert to increase performance?

Utilising a Business Model Canvas such as the example here from Strategyzer can be very helpful in this process. It allows you to have a big picture view of your entire value chain, make changes and understanding the impacts of the changes

Ready for Change?

Speak to our expert advisors today. Schedule a session with us by dropping an email to: support@forbisaccounting.com

Authors:

Jared ANG Rui Xiang

Business Development Associate

Azriel CHEE

Business Development Associate

Editor:

Ryan Adnin GOH

MBa, Certified Employment Intermediary (KAH)

Director of Advisory

Referenced Articles & Resources

- https://www.just-auto.com/interview/chinas-shift-to-online-sales-gathers-pace_id195475.aspx

- https://www.edb.gov.sg/en/news-and-events/insights/headquarters/covid-19-could-redefine-singapore-s-place-in-the-global-economy.html

- https://www.straitstimes.com/lifestyle/food/chope-survey-captures-devastating-impact-of-the-coronavirus-pandemic-on-fb

- https://www.bain.com/insights/coronavirus-and-other-shocks-how-resilient-is-your-supply-chain/

- https://www.channelnewsasia.com/news/business/covid-19-banks-sme-loans-interest-rate-mas-enterprise-singapore-12658938

- http://www.businessmodelalchemist.com/tools

- https://www.straitstimes.com/business/economy/60-of-consumer-spending-hit-by-circuit-breaker-measures-mas

- https://www2.deloitte.com/global/en/pages/risk/articles/covid-19-managing-supply-chain-risk-and-disruption.html